How to Choose the Right Mortgage for Your Situation

Choosing the right mortgage is a pivotal decision that will have a long-term impact on your financial well-being. The mortgage market offers a variety of

If your bank or lender has declined your application for a mortgage, you’re in the perfect spot. We are experts in securing mortgages for challenging cases!

Self employed get approved

Fast & simple approval

Lenders give us the best rates

Transparent Fee Structure

Diverse Loan Options

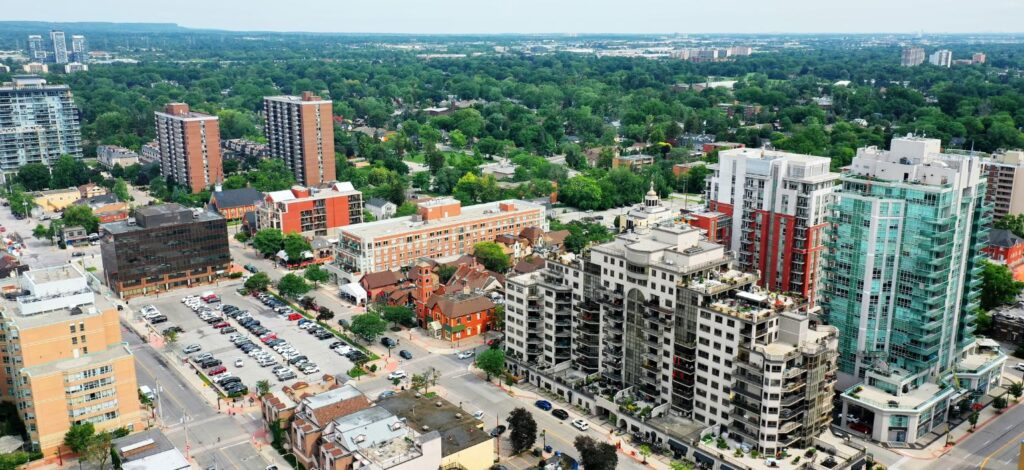

In Burlington, Donna’s approach to financial services, grounded in 30 years of mortgage expertise, offers a unique, personalized touch. She leverages an extensive lender network to tailor solutions, catering to the diverse needs of Burlington’s market.

Her range of services includes customized residential mortgages, specialized financing for dentists, and tailored plans for gas station owners. Donna’s adept at navigating complex financing scenarios like construction projects, often finding solutions where traditional banks may not.

For comprehensive mortgage services in Burlington, contact Donna at 1-877-336-3545. Her dedication to clients’ financial goals ensures a tailored, fulfilling journey, adeptly handling each unique financial situation with personalized care and expertise.

Contact Information

Expert guidance through every step of your mortgage acquisition journey.

Thorough initial assessment to provide personalized financial solutions.

We understand your specific financial requirements, whether it’s acquiring a home or expanding investments.

Crafting a tailored financing strategy for any credit profile.

We will develop a personalized financing strategy suited to your situation, regardless of your credit history.

Negotiating best terms and ensuring a seamless transition.

Advancing to the approval stage, we tailor terms to the client’s financial circumstances and stay in close contact.

Connect with a seasoned financial expert, offering over 30 years of experience in delivering customized mortgage solutions and exceptional service, dedicated to your financial success.

I have worked in the financial services industry for over 30 years, with most of those years involved in the mortgage field.

Over this time I’ve developed working relationships with a vast number of lenders, both institutional and private, in the commercial lending field. As a result my team has been able to provide both creative and timely solutions for clients where, previously, other avenues had failed.

Customer service is my number one priority, with special focus on what my client needs and how they can best be served. It is important that my clients be kept informed throughout the entire process.

Discover your ideal mortgage solution today. Whether you’re a homeowner or property investor, we are here to assist you. Let’s find the perfect financing for your unique needs.

Explore our comprehensive FAQ section, where we provide insightful answers to commonly asked questions. Get the information you need to make informed decisions about your mortgage journey.

Similar to other locations, Burlington clients can expect no broker fees, barring any major challenges with credit ratings.

Refinancing may involve penalties, which are often offset by savings from lower interest rates and debt reduction, a situation seen in areas like Burlington and beyond. This balance between potential costs and long-term savings is a common aspect of refinancing in various regions.

Despite a history of bankruptcy, we’ve assisted numerous Burlington clients in securing mortgage approvals.

For our clients in Burlington, I work closely with multiple private lenders enthusiastic about investing in property projects, whether it’s small-scale residential or extensive commercial developments.

In scenarios common across various regions, including Burlington, refinancing options for low-equity properties might exist if you have another property with sufficient equity, which can be used as security.

Yes, I have a strong foundation in residential mortgages in Burlington. I’m adept at navigating different residential property scenarios to find suitable mortgage options.

Absolutely, most lenders offer this standard protection from rate increases during your property purchase. While commonly seen in places like Burlington, this practice is widespread, helping borrowers secure their rates in a variety of markets.

Your credit score significantly impacts the mortgage rates available to you, with a higher score often leading to more advantageous terms. This is a common scenario not only in Burlington but in many regions, highlighting the universal importance of a good credit score in the mortgage application process.

Choosing a fixed-rate mortgage means enjoying consistent interest rates, a benefit not only for Burlington residents but for borrowers in many areas. Unlike variable-rate mortgages, which can fluctuate with market conditions, fixed rates provide stability and predictability across various regions.

While times vary, just as in Burlington, I’m committed to making your mortgage approval process swift and efficient, mirroring a common industry trend.

Discover firsthand accounts of Donna’s exceptional mortgage expertise and commitment to clients’ financial success. Hear what satisfied clients have to say about their experiences.

Google rating score: 4.6 of 5, based on 52 reviews

Stay Up To Date

Stay up-to-date on the latest mortgage news and changes with our blog.

We share valuable information and analysis on various mortgage-related topics to enhance your knowledge.

Choosing the right mortgage is a pivotal decision that will have a long-term impact on your financial well-being. The mortgage market offers a variety of

Mortgages are an essential part of buying a home, offering various options to suit different needs and financial situations. Understanding the types of mortgages available

Navigating mortgage rates can seem like a daunting task for both first-time homebuyers and seasoned investors. Mortgage rates can fluctuate based on various economic indicators,

Yesterday the Bank of Canada left the overnight rate unchanged again, stating that the economy is performing as expected. It is expected to remain unchanged